How to pay for business equipment and earn credit card rewards points

Upgrading equipment is one of the constants of doing business.

With technology always improving, new computers, IT systems and even printers have become fairly regular upgrades for many businesses.

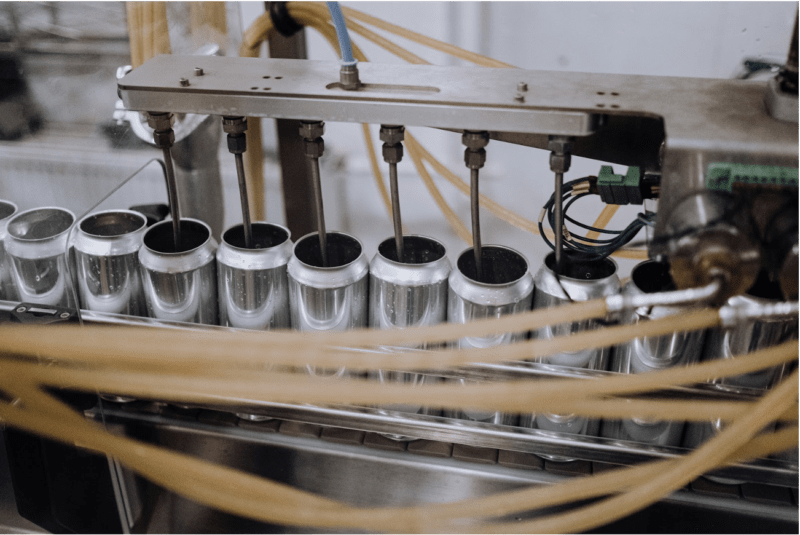

Trades people and construction workers need new tools from time to time, bustling cafes need bigger coffee machines and cleaners need new cleaning products.

Restaurants need to buy food to cook and sell, retailers need new shelving and manufacturers are always upgrading machines to improve efficiency and safety.

Farmers also need new machines and tractor tyres and gyms need new treadmills.

What if you could pay for all of these business equipment expenses – and more – using a points-earning credit card?

With pay.com.au, you can.

Even if your supplier does not accept credit card payments, we make any invoice easy to pay and help you on your way to a holiday.

With low fees and a simple and easy-to-use interface, pay.com.au can help you do business better.

You could be getting your bags packed for a Greek Islands getaway in no time.

How does paying for business equipment with a credit card work in the real world?

Let’s use a cafe as an example – one of Australia’s most popular small businesses.

A booming cafe is struggling to keep up with coffee orders in the morning and needs a new, larger coffee machine for the baristas to work from.

The cafe owner finds a machine they like from a wholesale supplier and places an order.

However, the supplier only accepts direct deposit fee-free, or it may allow VISA and Mastercard payments with a high surcharge attached.

Regardless, pay.com.au can facilitate this payment from the cafe owner to the wholesaler using any credit or charge card of the cafe owner’s choice.

We not only accept VISA and Mastercard but also take payments using American Express cards, which often provide higher points-earning potential.

We also have the lowest processing fees on the market – as little as 0.62% after potential tax savings.

Along with the cafe owner being able to earn thousands of frequent flyer points on this business equipment purchase, by paying with a credit card they could also enjoy up to 55 days interest free to help manage any short-term cash flow issues.

The benefits of using pay.com.au can be quite wide-ranging.

How quickly do suppliers receive funds for business equipment payments with pay.com.au?

The timing between a credit card payment made by you for business equipment through pay.com.au and receipt by the payee is typically only T+2 days.

Settlement processes of the card schemes and banks largely dictate this time, however we are working on implementing a same-day payment solution in the future.

How many points can you earn paying for business equipment with a credit card?

This really depends on the size of your business and, therefore, the size of your business expenses bills.

However, what we can tell you is that with the right business credit card you can earn up to 1.25 points per dollar spent on business equipment with pay.com.au

At that rate, $111,360 of business equipment purchases could have you on your way to Athens, Greece flying Business Class on Emirates.

For a builder or a manufacturing business who purchases tens or even hundreds of thousands of dollars of equipment regularly, the rewards points could quickly add up.

Don’t have a high points-earning business credit card?

Sign up to one of our well-priced subscription services and we can even help you pick the best card for your business to maximise your rewards.

We can even help you find and book the sometimes elusive First Class and Business Class rewards seats to help get you on your way to a well-deserved holiday.

What else can you use pay.com.au to pay for?

We don’t just allow businesses to make credit card payments for business equipment.

We can also process payments to contractors and consultants or assist in making rent payments.

You can even use our service to make payments for employee superannuation and pay ATO bills.

How do I sign up?

It’s easy.

Just head to pay.com.au and follow the prompts to sign your business up.

You too could soon be joining our growing number of very happy customers flying at the pointy end of the plane.

a 4-minute demo

a 4-minute demo